Real Estate, Development & Investment

- sarahchaudhry0

- Dec 13, 2023

- 3 min read

I recently taught MSc students about Real Estate, Development, and investment.

The twelve-week module covered the following topics:

Introduction to real estate (property) development and investment.

Assessing the feasibility of development.

Period by period cash flows in development appraisals.

DCF development appraisals.

Financial risk and scenario testing.

Funding development.

Challenging development situations and responses.

Property investment principles.

Investment portfolios and real estate.

Sustainability and real estate investment.

Build to rent.

Development viability and cost

Assignment 1 has been submitted and I marked them, the majority did well.

Independently and as required, should readers require staff training, I can do this, and a little more text on each topic is below, and key learning from marking as well.

Key learning

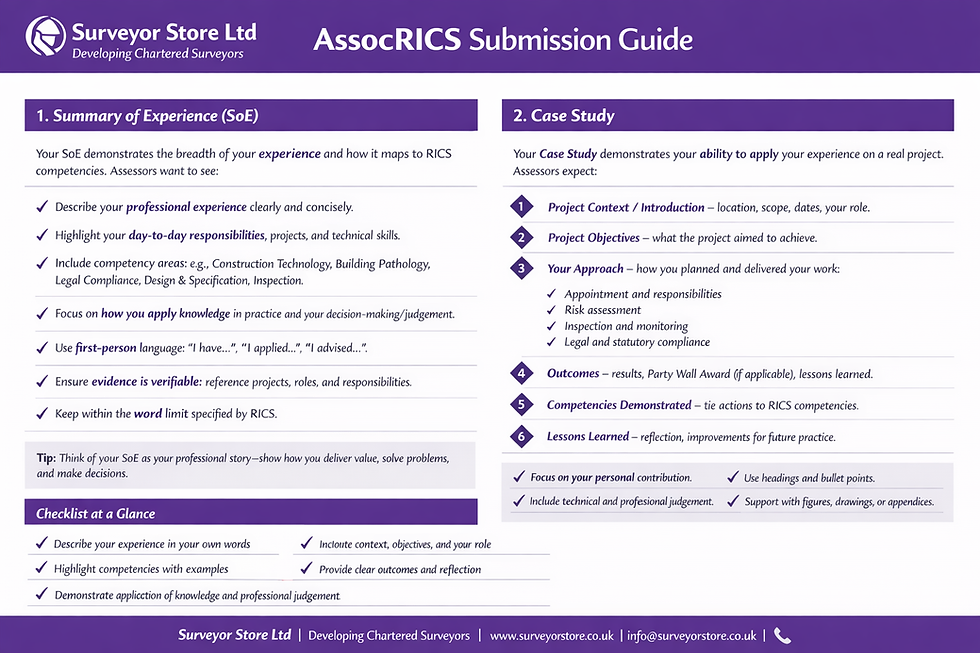

I put a template together to encourage students to answer the right question, I followed the approach the RICS adopts with APC candidates which is simple and to the point.

To understand the question is important, to do this attend class, and listen to lectures as they help to explain and detail what is required.

1.Introduction to real estate (property) development and investment

This lecture introduces the development process and gives an overview of investment and what it means.

At the heart of this is the approach to risk and the property cycle.

2. Assessing the feasibility of the development

The content looks at how cashflows can be used to model the expected costs and income across the timeline of a development, to test its financial viability.

The approach adopted is simple, it looks at spend and income and the two combined can help assess viability and value.

3. Period-by-period cashflows in development appraisals

Developers will normally start a project by undertaking a development appraisal to assess the feasibility of development.

Part of this will involve developing a period by period cashflow and this lecture looks at how to do this.

4. DCF development appraisal

Discounted cash flow (DCF) is an investment appraisal technique that assists decision-making where a large investment is contemplated.

DCF is an appraisal technique used in the property sector.

5. Financial risk and scenario testing

The construction industry is exposed to risks of various sorts, this talk focuses on financial risks and what, if anything, can be done to mitigate these.

It is not possible to eliminate all risks, and there a risk and reward relations, and some 'risk-seeking' maybe appropriate in some circumstances.

6. Funding development

Construction projects often require funding that exceeds the finance available to the developer.

At some point, a developer will need funding and this talk covers some of the sources available.

7. Challenging development situations

Sometimes beneficial projects may seem financially unviable and a little more ingenuity maybe needed to make them work.

This talk touches on some ways to progress projects it covers SPV's, TIF's, Clawbacks, and PFI, the important is that it stimulates conversations.

8. Property investment principles

This talk is a general introduction to Property Investment, is covers some of the terms and expressions.

The session explains the decision to invest reflects an interplay of risk against expected return and knowledge of alternate options.

9, Investment portfolios and real estate

This talk covers the approach an investor may take, it looks at diversification, the assets types, institutional investors and strategy, some theory, risk, and reward.

10. Sustainability and real estate.

This talk considers the relationship between sustainability and property (real estate) investment.

11. Build to rent

This talk looked at the build-to-rent market, this form of housing has become more popular over the past decade.

12. Development viability and cost

This talk is on development appraisals and explains how they are used to establish if a development is viable.

They can assess profit and land value and an approach called the residual method is often used.

Conclusion

The photo at the start is from a building I sold a few years before, it is also of land where I dealt with a title issue which led to a new school being built for 1850 secondary school children.

I have a long history in real estate and have done some good work, to find out more and to talk about a training arrangement get in contact.

Sarah Chaudhry

Director

Surveyor School, AMSI, and the Property Practice

Surveyor Store Ltd

07521 085400

Comments